The US Federal Reserve may have forced an early end to a global market party that began after retail inflation in the world's largest economy fell to a three-year low.

Markets were expecting at least three rate cuts before 2024 ends but Fed chair Jerome Powell walked out of the monetary policy review meeting more hawkish than anyone expected.

The US central bank hinted at only one rate cut this year but many believe that the inflation pressure in the US has started easing and it will only get better.

"If we get a couple of more months of inflation like the one we saw this morning (June 12), the Fed’s going to be cutting rates. My sense is that very well may happen soon,” Nathan Sheets, global chief economist at Citi, told CNBC-TV18. You can watch the whole interview here:

Jahangir Aziz, the global head of emerging market economics at JPMorgan, echoed a similar view.

"Broader financial conditions are not only easy, they are easing as we speak, even though the 10-year yield is probably telling you a different story till about yesterday. Today, after the inflation print, it is telling you a different story. So I think, even if you do get the start of an easing cycle, I don't think that a 10-year is going to reflect a lot of that because a lot of it has to be priced in already in the 10-year," Aziz said in a conversation with CNBC-TV18.

Simply put, the market has already priced in a fall in US interest rates despite what Powell said in the press conference after the monetary policy review.

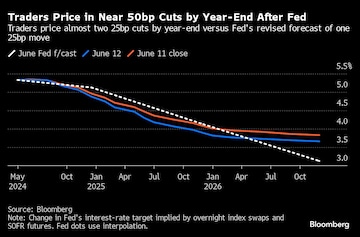

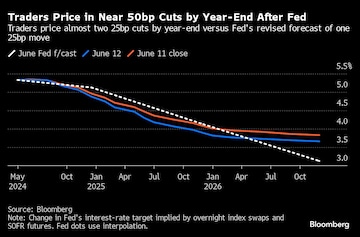

It's not just economist, even traders expect Fed to ease rates more than what Powell has indicated

Charu Chanana, a strategist at Saxo Capital Markets told Bloomberg that the signs are clear that inflation is easing and the US Fed may cut rates sooner, which will prop up Asian markets too.

Earlier, on June 12, Bloomberg asked 97 market participants where they expect the US blue-chip stocks to be at by the end of the year.

Over half of them expected a 14% increase in S&P500 by the end of the year, regardless of whether there’s an interest rate cut from the US Fed or not.

This is consistent with another survey CNBC-TV18 reported on May 29, which showed that the faith in the US economy has more than doubled since the beginning of the year.

However, bulk of the rally is expected in tech stocks like Nvidia, Apple, Alphabet and Amazon, whereas traders expect non-tech stocks to either be laggards or end the year lower than where they started at.

ALSO READ:

How US Fed's policy shift hit gold prices today

View | A tale of two EM elections

What it may take for India's GDP to grow at 8%

Markets were expecting at least three rate cuts before 2024 ends but Fed chair Jerome Powell walked out of the monetary policy review meeting more hawkish than anyone expected.

The US central bank hinted at only one rate cut this year but many believe that the inflation pressure in the US has started easing and it will only get better.

"If we get a couple of more months of inflation like the one we saw this morning (June 12), the Fed’s going to be cutting rates. My sense is that very well may happen soon,” Nathan Sheets, global chief economist at Citi, told CNBC-TV18. You can watch the whole interview here:

Jahangir Aziz, the global head of emerging market economics at JPMorgan, echoed a similar view.

"Broader financial conditions are not only easy, they are easing as we speak, even though the 10-year yield is probably telling you a different story till about yesterday. Today, after the inflation print, it is telling you a different story. So I think, even if you do get the start of an easing cycle, I don't think that a 10-year is going to reflect a lot of that because a lot of it has to be priced in already in the 10-year," Aziz said in a conversation with CNBC-TV18.

Simply put, the market has already priced in a fall in US interest rates despite what Powell said in the press conference after the monetary policy review.

It's not just economist, even traders expect Fed to ease rates more than what Powell has indicated

A Bloomberg survey showed that traders expect a 50 basis points cut in US interest rates before the end of 2024.

Charu Chanana, a strategist at Saxo Capital Markets told Bloomberg that the signs are clear that inflation is easing and the US Fed may cut rates sooner, which will prop up Asian markets too.

Earlier, on June 12, Bloomberg asked 97 market participants where they expect the US blue-chip stocks to be at by the end of the year.

Over half of them expected a 14% increase in S&P500 by the end of the year, regardless of whether there’s an interest rate cut from the US Fed or not.

This is consistent with another survey CNBC-TV18 reported on May 29, which showed that the faith in the US economy has more than doubled since the beginning of the year.

However, bulk of the rally is expected in tech stocks like Nvidia, Apple, Alphabet and Amazon, whereas traders expect non-tech stocks to either be laggards or end the year lower than where they started at.

ALSO READ:

How US Fed's policy shift hit gold prices today

View | A tale of two EM elections

What it may take for India's GDP to grow at 8%

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!