By CNBCTV18.COM | Jun 11, 2024 3:45 PM IST (Updated)

Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

“Nifty remained sideways during the day as there was no directional move. The sentiment might remain sideways as well until it breaks out of the 23150-23350 range. Any decisive breakout on either side might confirm the future direction of the market. On the higher end, above 23350, it might move towards 23600. Meanwhile, support below 23150 is placed at 23000-22900,” says Rupak De, Senior Technical Analyst, LKP Securities.

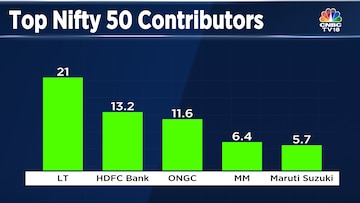

Midcap Outperformance Keeps Mkt Breadth In Favour Of Advances

Midcap Index Hits Record High For 2nd Straight Session

Financials Remain A Drag, Kotak Bk & ICICI Bk Top Losers

Sensex Falls 33 Points To 76,457 While Nifty Rises 6 Points To 23,265

Nifty Bank Slips 75 Pts To 49,706 While Midcap Index Rises 431 Pts To 53,667

Govt Looking To Bring Oil & Gas Under GST Lifts Stocks Of The Sector

ONGC, Oil India, City Gas Cos See Fresh Buying, Stocks Up 1-8%

Cement & Hsg Fin Cos Remain In Focus On Govt’s Housing Plan

Rail Stocks Surge On Ashwini Vaishnaw Continuing Rail Min

Andhra Govt’s Plan To Expand Amravati Airport Lifts GMR Airports

IndiGo & IRB Infra Slide Following Major Block Deals, Down 4-6%

Mkt Cap Of BSE-Listed Cos Is At A Record High Of ₹427 Lk Cr ($5.11 Trillion)

BSE-listed Cos Add Market Cap Of More Than ₹1.50 Lk Cr On Tuesday

Kaynes Technology India, an electronics manufacturing services (EMS) company with a market cap of $2.7 billion, aims to achieve over 60% revenue growth for the second year in a row.

Read more here

Here are a couple of stock recommendations by Dharmesh Shah, Assistant VP, ICICI Securities:

– Buy L&T at a target of Rs 3,870 with a stop loss of Rs 3,280

– Buy PNB Housing at a target of Rs 896 with a stop loss of Rs 750

PNC Infratech shares tanked over 8% on Tuesday, June 11, after CBI’s search operations on the company’s premises led to the arrest of four employees.

The company in a stock exchange filing on Monday, June 10, said the Central Bureau of Investigation (CBI) conducted search operations at the residences of managing director Yogesh Kumar Jain and whole-time director Talluri Raghupati Rao and also at the firm’s offices in Agra and Delhi on June 8 night.

Here are a couple of stock recommendations by Dharmesh Shah, Assistant VP, ICICI Securities:

Buy L&T at a target of Rs 3,870 with a stop loss of Rs 3,280

Buy PNB Housing Finance at a target of Rs 896 with a stop loss of Rs 750

Laurence Balanco of CLSA is of the view that the Nifty 50 index, by the end of the decade, could see targets of as high as 37,000. His target range for the Nifty by the end of this decade ranges from 30,000 to 37,000. From current levels, this implies an upside potential between 28% to 58% on the Nifty.

For the more near term, Balanco believes that the Nifty is in a consolidation period, where the upside is limited to levels of 23,700 – 23,800. “The level we are highlighting as where you accumulate or rebuild positions here is on volatility and corrections back towards the 21,000 area,” Balanco said in an exclusive interaction with CNBC-TV18.

State-controlled Oil and Natural Gas Corporation (ONGC) will kick off gas production from its flagship deep-water project in the Krishna-Godavari (KG) basin block KG-DWN-98/2, said Hardeep Singh Puri as he takes charge of the Petroleum Ministry.

Read more here

The tie-up aims to foster industry and academia advancement in the domains of Advanced Driver Assistance Systems (ADAS) and Cellular Vehicle-to-Everything (CV2X) communication, L&T Technology Services said in a stock exchange filing.

Read more here

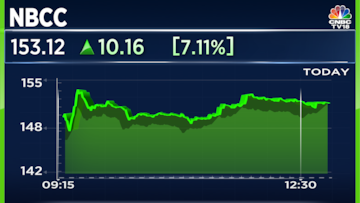

NBCC shares are trading over 7% higher.

The stock has gained 17.81% in the past month, 91.24% in the last six months and 265.47% in the past year.

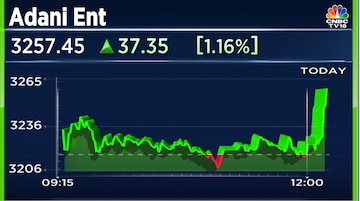

Adani Enterprises Ltd. on Tuesday, June 11, said Adani Defence & Aerospace has signed a cooperation agreement with UAE-based EDGE Group.

“The agreement aims to establish a global platform leveraging the defence and aerospace capabilities of both companies to bring together their respective product portfolios and cater to the requirements of global and local customers,” the company said in a statement.

Here are a couple more stock recommendations by technical analyst Mitessh Thakkar:

– Buy Exide Industries at a target of Rs 555 with a stop loss of Rs 528

– Buy Can Fin Home Finance at a target of Rs 820 with a stop loss of Rs 774

The agreement will explore establishment of R&D facilities in India and UAE

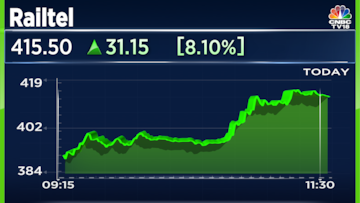

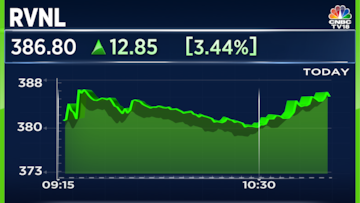

After rallying over 100% so far this year, heavy buying was witnessed in shares of railway stocks like RVNL and IRFC along with IRCON, RailTel and IRCTC. All these stocks are up between 3% and 10% on Tuesday (June 11).

IRFC shares are currently trading 3% higher at ₹177.80. At the current level, the shares had risen 76% so far in 2024. Even shares of Railtel are up 7.70% in today’s trading session.

Here are a couple of stock recommendations by Shilpa Rout, Prabhudas Lilladher:

Buy HDFC Life at a target of Rs 590 to Rs 600 with a stop loss of Rs 564

Buy Crompton at a target of Rs 435 to Rs 440 with a stop loss of Rs 410

Railtel shares are in the green for the fourth day today, up over 8%.

The stock has gained 16.48% in the past month, 40.98% in the last six months and 215.9% in the past year.

Nifty Midcap index hit record high, crossed earlier level of 53,705.8

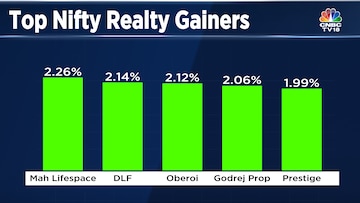

The Nifty Realty index is the top gainer among sectoral indices, up 1.56%.

All 10 stocks in the index are in the green.

RVNL shares are in the green again today after a day’s lapse. The stock has been in the green for four out of the last five trade sessions.

It has gained 50.91% in the past month, 116.46% in the last six months and 211.83% in the past year.

Here are a couple of stock recommendations by technical anaylst Mitessh Thakkar:

Buy Bajaj Finance at a target of Rs 7,300 with a stop loss of Rs 7,050

Buy Britannia Industries at a target of Rs 5,660 with a stop loss of Rs 5,540

Tata Chemicals shares gained more than 2% on Tuesday, June 11, after the American Natural Soda Ash Corporation (ANSAC) announced that it is raising export prices by $25/MT from July 1.

With ANSAC raising rates, Tata Chemicals may find an opportunity to follow suit, which could enhance their revenue without losing competitive positioning, given the overall market trend of tightening supply and increasing demand, according to Centrum.