By CNBCTV18.COM | Jun 13, 2024 2:02 PM IST (Updated)

Following the softer-than-expected CPI release earlier in the day, the Fed’s new rate predictions likely unsettled the markets, causing a drop in Bitcoin prices.

According to CoinDesk data, the leading cryptocurrency by market value fell to $67,400 after the Fed’s announcement, reversing its post-CPI surge to $70,000.

However, there is confidence that the rally will soon resume, Coindesk said in an article quoting a 10x Research.

“Our recommendation remains unchanged: to stick with the winners (Bitcoin) and avoid others (such as Ethereum). Our previous analysis has shown that a lower CPI number tends to lift Bitcoin prices, and we anticipate this trend will continue,” Markus Thielen, founder of 10x Research, said in a note to clients on Thursday.

“Broader financial conditions are not only easy, they are easing as we speak, even though the 10-year yield is probably telling you a different story till about yesterday, today after the inflation print is telling you a different story.

So I think, even if you do get a start of an easing cycle, I don’t think that a 10-year is going to reflect a lot of that because a lot of it has to be priced in already in the 10-year,” said Jahangir Aziz, Global Head of Emerging Market Economics at JPMorgan, said in a conversation with CNBC-TV18.

“If we get a couple of more months of inflation like the one we saw this morning (June 12), the Fed’s going to be cutting rates. My sense is that very well may happen soon,” Nathan Sheets, global chief economist at Citi, told CNBC-TV18. You can watch the whole interview here.

As of 0340 GMT, spot gold had fallen by 0.4%, bringing its price down to $2,313.92 per ounce.

Similarly, US gold futures saw a more significant drop of 1.1% to $2,329.50 per ounce.

In India, MCX gold futures (August 5 contract) declined by ₹515 or 0.72%, trading at ₹71,455 per 10 grams.

“While the tamer consumer price index print was a net positive for gold, the takeaway from the Fed meeting was that the number of rate cuts in 2024 have been reduced and are still some distance down the road,” Tim Waterer, chief market analyst at KCM Trade was quoted as saying in a Reuters report.

“Powell presented his dot plot and said, look, our committee’s central tendency at the moment is one cut. But he hardly fell on his sword about it. He emphasised it was a conservative approach.”“A number of other members of the committee said, one month of inflation is not going to dramatically change either my forecast or my expectations for policy,” he added.

Bloomberg surveyed 97 market participants where they expect the US blue-chips to be at by the end of the year. More than half of them expected a 14% increase in S&P500 by the end of the year, regardless of whether there’s an interest rate cut from the US Fed or not.

As we reported earlier on May 29, the faith in the US economy has more than doubled since the beginning of the year.

US inflation eased in May, for a second straight month, which led the markets to anticipate a cut in interest rates sooner than later. However, those hopes came undone with the hawkish comments from the US Fed.

The growth in the US economy has come with stubborn inflation. “I don’t think anyone … has a definitive answer why people are not as happy about the economy as they might be,” said Jerome Powell, the Chair of US Federal Reserve.

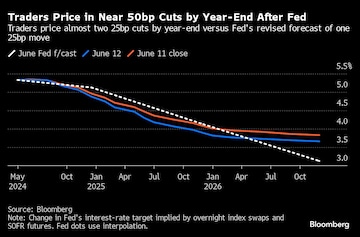

“Given that there are clear signs that data is softening, markets will continue to expect the Fed to cut rates sooner, and that can support Asian markets,” said Charu Chanana, a strategist at Saxo Capital Markets told Bloomberg. “The market is discounting the Fed’s cautious stance given it seems to come because of the dovish pivot earlier that proved premature.”

Source: Bloomberg

We will now wrap the blog. Good night, folks!

US stocks are climbing Wednesday following a surprisingly encouraging update on inflation. The Federal Reserve also gave reassurance that its policymakers still see a cut to interest rates, something Wall Street deeply desires, as likely this year.

The S&P 500 was 1% higher in afternoon trading and on track to add to its all-time high set a day earlier. The Nasdaq composite was also building on its own record and was up 1.9% as of 3 pm. Eastern time. The Dow Jones Industrial Average was lagging the market and was close to flat.

The Federal Reserve’s restrictive stance on monetary policy is having the effect on inflation central bankers had hoped to see, Fed Chairman Jerome Powell said Wednesday afternoon. But central bankers are still waiting to see sufficient progress, he added, reported CNBC.

“The question of whether it’s sufficiently restrictive is going to be one we know over time,” Powell said. “But I think for the reasons I talked about at the last press conference and other places, I think the evidence is pretty clear that policy is restrictive and is having, you know, the effects that we would hope for.”

Fed Chair Jerome Powell said it’s unclear why the sentiment of everyday Americans is so sour on the economy, reported CNBC.

“I don’t think anyone … has a definitive answer why people are not as happy about the economy as they might be,” he said.

However, he did say there’s a growing economy and a strong labour market. While inflation ran high, he noted that the pace of price increases has come down “significantly.”

Federal Reserve Chair Jerome Powell said no one on the committee has interest rate hikes in their base case, reported CNBC.

“We think the policy is restrictive. And we think, ultimately, that if you just set policy at a restrictive level, eventually you will see a real weakening in the economy,” he said. “So, that’s always been the thought is that you know, since we raised rates this far, we’ve always been pointing to cuts at a certain point.”

“Not to eliminate the possibility of hikes, but no one has that as their base case,” Powell said. “No one on the committee does.”

Fed Chair Jerome Powell said the recent strong jobs data might be slightly “overstated,” indicating that benchmark revisions could be on the way. reported CNBC.

“…there’s an argument that they may be a bit overstated, but still, they are strong,” Powell said, referring to US payroll reports. “We see gradual cooling, gradual moving toward better balance.”

Federal Reserve Chair Jerome Powell said the central bank does not yet have the confidence to start lowering interest rates, even after May’s consumer price index on Wednesday came in cooler than expected, reported CNBC.

“We see today’s report as progress and as, you know, building confidence,” Powell said. “But we don’t see ourselves as having the confidence that would warrant beginning to loosen policy at this time.”

Jerome Powell said that Fed members were given the chance to update their answers for the Summary of Economic Projections in light of this morning’s CPI report, reported CNBC.

“We make sure people remember that they have the ability to update. We tell them to do that…What’s in the SEP actually does reflect the data that we got today, to the extent you can reflect it in one day,” Powell said.

Inflation data this year has not yet given the Federal Reserve “greater confidence” that it’s moving closer to the 2% goal, according to Fed Chair Jerome Powell, reported CNBC.

“We will need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%,” he said.

The most recent string of inflation readings is showing signs of cooling price pressures, according to Federal Reserve Chair Jerome Powell.

“The inflation data received earlier this year were higher than expected, though more recent monthly readings have eased somewhat,” Powell said on Wednesday. “Longer-term inflation expectations appear well anchored.”

Inflation has eased substantially from its peak but remains too high, Federal Reserve chair Jerome Powell said during his Wednesday press conference, reported CNBC.

“Our economy has made considerable progress…the labor market has come into better balance with continued strong job gains and a low unemployment rate,” he said.

“Inflation has eased substantially from a peak of 7% to 2.7% but is still too high. We are strongly committed to returning inflation to our 2% goal in support of a strong economy that benefits everyone.”

Fed Chair Jerome Powell began his news conference by noting the US economy has made progress toward both of the central bank’s goals: bringing inflation down to 2% and maximizing employment, reported CNBC.

“Our economy has made considerable progress toward both goals over the past few years,” Powell said. “The labour market has come into better balance, with continued strong job gains and a low unemployment rate. Inflation has eased substantially from [about] 7% to 2.7%. But it’s still too high,” he said.

The S&P 500 and Nasdaq Composite held onto their gains as of 2:19 p.m. ET, with the broad market benchmark up 1% and the tech-heavy index up nearly 1.8%. The Dow Jones Industrial Average added about 32 points, reported CNBC.

For the period through 2025, the Federal Open Market Committee now sees five total cuts equaling 1.25 percentage points, down from six in March, reports CNBC.

If the projections hold, it would leave the federal funds rate benchmark at 5.1% by the end of next year, higher by 0.2 percentage points than the March outlook.

The US Fed’s rate cut forecasts reflect separate estimates from 19 different policymakers. The Fed said that 8 of those officials projected two cuts, 7 projected one, and four said they expect no cuts at all this year.

US Federal Reserve officials said Wednesday that inflation has fallen further toward their target in recent months but signalled that they expect to cut their benchmark interest rate just once this year. The policymakers’ forecast for one rate cut was down from a previous forecast of three, likely because inflation remains persistently elevated.

Top 10@10— CNBC-TV18’s daily newsletter featuring the top 10 stories on markets, corporate updates, economic insights, and financial highlights — delivered at 10 PM. Read here.

US Fed holds rates steady, signals only one rate cut expected this year.

More inflation readings like the May CPI report could help the stock market move away from its reliance on mega-cap tech, according to Key Private Bank CIO George Mateyo, reported CNBC.

“We have been thinking for a while that small-cap stocks are due for some recovery, and we’ve kind of seen that today. So I think it’s fair to say that the market is positioned…that when the Fed does decide to shift to the downside and start thinking about cutting rates, you’ll see more participation,” Mateyo told CNBC in a phone call Wednesday.

The drop in auto insurance was a key reason why core inflation came in so low in May. Insurance rates have jumped because the prices of new and used cars soared during the pandemic, mostly because of supply shortages. Insurers must pay more to replace wrecked cars, and the companies have raised premiums to offset those higher costs.