Here’s why UBS is bullish on the tech equipment players

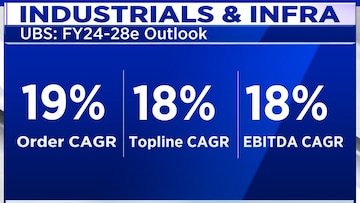

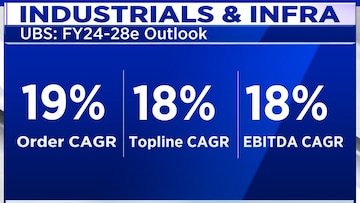

Amit Mahawar, Executive Director and Industrial Analyst at UBS Investment Research, expects 18-19% compounded annual growth in new order earnings in the space over the next three to four years.

UBS Investment Research is bullish on the future of tech equipment players, due to a range of policy initiatives expected to persist under the National Democratic Alliance's third term (NDA 3.0).

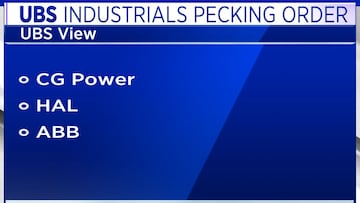

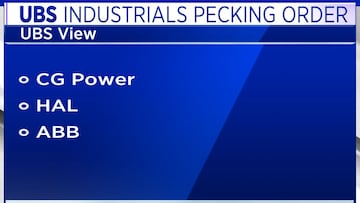

It is particularly positive on companies that have a strong domestic demand and a growing export business even though valuations in some cases are now expensive.

“The challenge around valuations has always been there for last so many years in industry but it has gone up multi-fold in last particularly 12 months. But I think if you see the growth at least on our coverage, we expect 18 to 19% new order earnings compounding in the next three to four years which should keep the investors interest high," Amit Mahawar, Executive Director and Industrial Analyst at UBS Investment Research told CNBC-TV18.

He noted that a lot of these companies are working on expansion of their addressable market which also justifies the premium valuations most of them are commanding right now.

Mahawar also foresees growth propelled by momentum in urban infrastructure, defence, mobility, and sustained private capital expenditure (capex).

“Most of the policy initiatives on the industrial side, whether it's the production linked incentive (PLI) scheme or defence manufacturing policies, have shown favourable impacts over the last decade,” Mahawar stated.

He expects these initiatives to continue, benefiting select pockets of the sector.

The government's policies from the previous two terms are likely to persist, ensuring a steady stream of orders for product companies.

This continuity is already reflected in the recurring order run rates and profitability of these firms.

While UBS does not foresee a resurgence of strong greenfield capacity expansions reminiscent of the 2004-2009 period, it does anticipate significant private spending focused on upgrading factory setups. This shift is partly driven by the need to meet export market requirements.

Certain segments, such as railways, data centers, and electrification portfolios, are expected to drive sustainable and recurring growth. These areas, coupled with efficiency-driven private capex, are making a significant impact.

It is particularly positive on companies that have a strong domestic demand and a growing export business even though valuations in some cases are now expensive.

“The challenge around valuations has always been there for last so many years in industry but it has gone up multi-fold in last particularly 12 months. But I think if you see the growth at least on our coverage, we expect 18 to 19% new order earnings compounding in the next three to four years which should keep the investors interest high," Amit Mahawar, Executive Director and Industrial Analyst at UBS Investment Research told CNBC-TV18.

He noted that a lot of these companies are working on expansion of their addressable market which also justifies the premium valuations most of them are commanding right now.

Mahawar also foresees growth propelled by momentum in urban infrastructure, defence, mobility, and sustained private capital expenditure (capex).

“Most of the policy initiatives on the industrial side, whether it's the production linked incentive (PLI) scheme or defence manufacturing policies, have shown favourable impacts over the last decade,” Mahawar stated.

He expects these initiatives to continue, benefiting select pockets of the sector.

The government's policies from the previous two terms are likely to persist, ensuring a steady stream of orders for product companies.

This continuity is already reflected in the recurring order run rates and profitability of these firms.

While UBS does not foresee a resurgence of strong greenfield capacity expansions reminiscent of the 2004-2009 period, it does anticipate significant private spending focused on upgrading factory setups. This shift is partly driven by the need to meet export market requirements.

Certain segments, such as railways, data centers, and electrification portfolios, are expected to drive sustainable and recurring growth. These areas, coupled with efficiency-driven private capex, are making a significant impact.

(Edited by : Shweta Mungre)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!