By CNBCTV18.COM | Jun 10, 2024 4:05 PM IST (Updated)

Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

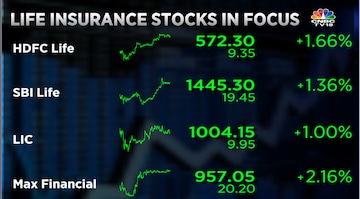

“The top pick, according to me, has to be LIC, considering that they are making the phenomenal amount of profit in such markets, and they are still trading below their enterprise value.

They are managing their growth rate, keeping their market share also intact. So, in the case of LIC, you would see compounded growth rates as well as definitely would bet on rerating for valuation multiples for LIC, but nonetheless positive on all insurance companies.”

World stocks were mostly lower on Monday after a US jobs report released Friday came in hotter than expected, while the euro fell after French President Emmanuel Macron dissolved the National Assembly following a setback in Sunday’s parliamentary election.

Far-right parties made major gains in parliamentary elections Sunday, leading French President Emmanuel Macron to call a snap election. This caused the euro to drop to its lowest price in nearly a month. The euro was trading at $1.0766, down from $1.0778.

The setbacks for incumbent parties cast a shadow across the region. The CAC 40 in Paris sank 1.7% to 7,866.87 and Germany’s DAX lost 0.7% to 18,425.26. Britain’s FTSE 100 declined 0.4% to 8,215.84 in early trading.

Market Ends Largely Lower Financials Slip In The Last Hour

Sensex Hit Intra-day Record High Of 77,079 & Nifty 23,412

Midcaps Mildly Outperform Benchmarks, Mkt Breadth Favours Advances

Sensex Falls 203 Points To 76,490 & Nifty 31 Points To 23,259

Nifty Bank Slips 22 Pts To 49,781 While Midcap Index Rises 41 Pts To 53,236

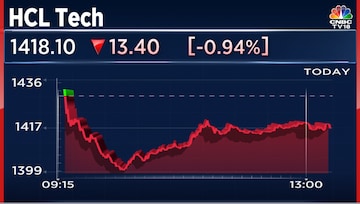

IT Stocks Slip As Rate Expectations Dim On Strong Jobs Data, Index Down 2%

4 Of Top 5 Nifty Losers Are IT Stocks (Tech Mah, Infosys, Wipro & LTIM)

Most Life Ins Cos Report Healthy Biz Updates For May, Stocks Up 1-3%

Buying In Cement Stocks Continues On Expectation Of Govt’s Housing Push

Samvardhana Motherson Extends Gaining Streak, Up Another 5% Today

Fertiliser Stocks See Buying As PM Releases Kisan Samman Nidhi Instalment

Mphasis Falls 3% As Stock Sees Block Deals Of Up To 15% Equity

GAIL Ends 5% Off Highs On `60,000 Cr Investment For Ethane Cracker Project

#OnCNBCTV18 | India has had a history of coalition governments & macro stability will be the key focus. Skeptics have to be reminded that reform is carried out by the will of the leader, Ridham Desai to CNBC-TV18

Here’s more 👇 pic.twitter.com/yDYT1nNh9Y

— CNBC-TV18 (@CNBCTV18Live) June 10, 2024

#OnCNBCTV18 | Ridham Desai adds, Indian demographics will not reverse in the next 10 years. India could be the only large country in the world with a primary balance Here’s more 👇 pic.twitter.com/gSQPIj8wrh

— CNBC-TV18 (@CNBCTV18Live) June 10, 2024

#CNBCTV18Market | #Market erases gains, #Sensex & #Nifty down 0.2% & 0.1% respectively pic.twitter.com/rfHOy5DwEy

— CNBC-TV18 (@CNBCTV18Live) June 10, 2024

LIFE INSURANCE MAY BIZ DATA AFTER FACTORING IN BASE EFFECT

1⃣HDFC Life Has Grown Strongest If Base Affect Is Adjusted For 👇

**May 2024: Prem +14% Vs May 2023: Prem +32%2⃣Max Life’s Would Follow HDFC Life In The Order Of Being Strongest 👇

**May 2024: Prem +23% Vs May 2023:… https://t.co/63xIjwWwij— Yash Jain (@YashJain88) June 10, 2024

Bharat Dynamics, a manufacturer of ammunition and missile systems, is targeting new orders worth ₹20,000 crore over the next 2-3 years.

Read more here

Recommendations by Ashish Kyal, Waves Strategy Advisors:

Buy Varun Beverages with a target of ₹1,700

Buy GNFC for a target of ₹720 with a stop loss at ₹645

Buy General Insurance Corporation for a target of ₹415 with a stop loss at ₹375

GAIL submits a request to the MP Govt to provide suitable enablers for the project. Intends to set up 1,500 KTA Ethane cracker project in MP, investment at ₹60,000 crore

Life insurance stocks are at day’s high after May business data. All life insurers except SBI Life posted strong business data.

Industrials, real estate, and PSU stocks have surged between 80% and 100%, making it crucial for investors to be more selective compared to FMCG and private sector banks, which have only seen gains of around 10-20%.

Read more here

#JustIn | Fischer Chemic co’s arm Fischer Medical Ventures partners with Blusim Tech PTE to redefine elderly care pic.twitter.com/NMFlTVZPVL

— CNBC-TV18 (@CNBCTV18Live) June 10, 2024

#JustIN | #Havells partners with Jumbo Group for kitchen appliances in UAE

Jumbo Group is a leading distributor of cons electric & tech products in the UAE pic.twitter.com/0yWGhwmU49

— CNBC-TV18 (@CNBCTV18Live) June 10, 2024

Recommendations by Sacchitanand Uttekar, Tradebulls:

Buy SRF for a target of ₹2,500 with a stop loss at ₹2,310

Buy Chambal Fertilisers for a target of ₹475 with a stop loss at ₹410

Recommendations by Soni Patnaik of JM Financial Services:

Buy Zydus Life for a target of ₹1,120-1,125 with a stop loss at ₹1,060

Buy Indus Tower for a target of ₹370-375 with a stop loss at ₹340

May saw the highest-ever monthly equity inflows, propelled by an influx of funds into New Fund Offers (NFOs) and thematic funds. Thematic funds witnessed an inflow of ₹19,213 crore.

Read more here

Shares of leading technology and engineering solutions company Axiscades Technologies surged over 10% on Monday after the company announced the beginning of the delivery of advanced counter-drone systems to the Indian Army as a part of a ₹100-crore order.

Read more here

Suzlon Energy shares have declined as much as 9% from its record high levels of ₹52.10, hit on June 4, 2024. The stock hit the 5% lower circuit in early deals today after one of the company’s independent directors, Marc Desaedeleer resigned with effect from June 8, citing corporate governance issues at the Pune-based firm.

Shares of Motilal Oswal Financial Services gained as much as 20% on Monday taking the stock to an all-time high.

Read more here

The shares of the company are trading 2.8% higher at this hour at ₹200 apiece.

44 lakh shares equivalent to 4.8% equity worth ₹319.6 crore change hands at an average of ₹725 per share.

Recommendations by technical analyst Mitessh Thakkar:

Buy ACC for a target of ₹2,630-2,635 with a stop loss at ₹2,518

Buy Britannia Industries with a target of ₹5,600

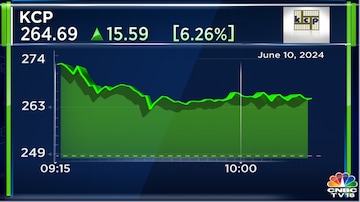

KCP shares have risen nearly 50% in the last four trading sessions after Chandrababu Naidu’s TDP wins in Andhra Pradesh.

As many as 44 lakh shares or 4.8% equity worth ₹319.6 crore changed hands in a block deal today.