By CNBCTV18.COM | Jun 12, 2024 3:40 PM IST (Updated)

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Market Hits Record High Intra-day, But Ends Off Highs

Nifty Hits Record High Of 23,442, But Closes 120 Pts Off That Level

Midcap Index Hit Life High For 3rd Straight Session

Midcap Outperformance Keeps Mkt Breadth In Favour Of Advances

Nifty Bank Fails To Hold Levels Above 50,000, Ends With Minor Gains

Sensex Rises 150 Points To 76,607 & Nifty 58 Points To 23,323

Nifty Bank Gains 189 Points To 49,895 & Midcap Index 560 Points To 54,226

Cement Stocks See Buying On Reports On Price Hike, Ambuja Top Gainer

Federal Bk Rises 4% On Rpts Of Bk Sending Names To RBI For MD & CEO Post

Hsg Fin Cos Continue To See Buying On Govt’s Hsg Push, Lic Hsg Up 5%

PSU Cos Continue To See Investor Interest, Nifty PSE & CPSE Up 1% Each

CONCOR, NMDC, Coal India & Pwr Grid Are Top PSU Gainers

2-wheeler Auto Stocks Gain On Rpts Of Industry Asking For GST Rate Cut

FMCG Stocks Come Under Pressure, Marico, HUL, Britannia Top Losers

Market Cap Of BSE-listed Cos At A Record High Of `429 Lk Cr ($5.14 Trillion)

BSE-listed Cos Gain Market Cap Of More Than `2 Lakh Crore On Wednesday

The initial public offering (IPO) of piping solutions company Dee Development Engineers will open for public bidding on June 19, and investor can subscribe the issue until June 21, 2024. The company is looking to raise ₹418 crore through its initial share sale.

The engineering company will sell its shares in the price range of ₹193 to ₹203 apiece, and investors can apply for a minimum of 73 equity shares in one lot and its multiples thereafter.

#CNBCTV18Exclusive | Prestige’s hotel business IPO soon?

Company appoints JM Financial, JP Morgan & CLSA as bankers for Hospitality Business IPO. The company eyes valuation of ₹17,000-20,000cr for hospitality business, sources to @VivekIyer72 pic.twitter.com/bDXtPuvXG6

— CNBC-TV18 (@CNBCTV18Live) June 12, 2024

Here are a couple of stock recommendations by technical analyst Mitessh Thakkar:

Buy Astral at a target of Rs 2,300 with a stop loss of Rs 2,200

Buy Bajaj Finance at a target of Rs 7,420 with a stop loss of Rs 7,125

Indegene shares gained over 4% on Wednesday, June 12, after the company informed the stock exchanges about its strategic collaboration with the Indian Institute of Science (IISc) and Ignite Life Science Foundation.

The company, in a stock exchange filing, said that IISc, Bengaluru, and Ignite Life Science Foundation (LSF), a Bengaluru-based science philanthropy, have joined hands with Indegene to advance scientific discoveries in India.

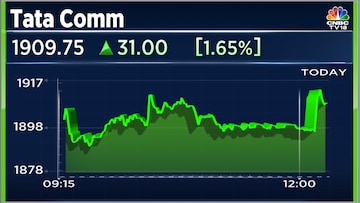

Tata Communications on Wednesday, June 12, announced a five-year global host broadcasting services deal to cover the World Athletics Series of events.

“The collaboration kicks off in another huge year for the sport, with 2025 including the World Athletics Indoor Championships in Nanjing in March, World Athletics Relays in Guangzhou in May and World Athletics Road Running Championships in San Diego in September, as well as the flagship World Athletics Championships in Tokyo,” the company said in a statement.

Here are a couple of stock recommendations by Ruchit Jain, 5paisa.com:

– Buy LIC Housing Finance at a target of Rs 760 Rs 770 with a stop loss of Rs 685

– Buy SBI Life at a target of Rs 1,520 with a stop loss of Rs 1,420

L&T Technology Service announced a dividend of ₹33 per share along with its March quarter results, which is the highest payout ever from the L&T group technology services provider.

Shares of Suzlon Energy Ltd. have delivered double-digit returns in 2024. The stock surged 4% to hit a day’s high of ₹50.47 on Wednesday, compared to its last closing price of ₹48.25. Suzlon shares are trading near their record high of ₹52.10 that it hit on June 4 this month.

While responding to a query about dividends, Suzlon’s Chief Financial Officer (CFO) Himanshu Mody mentioned that the company has a business plan set to be achieved in the financial year 2025, making it likely that the discussion will probably happen around May 2025.

Shares of Go Digit, which debuted on the stock exchanges last month, climbed by as much as 10.04% on Wednesday (June 12) to hit a fresh 52-week high of ₹372.35 per share. Read here

Private sector lender Federal Bank has likely submitted three names to the Reserve Bank of India (RBI) for the position of Managing Director and Chief Executive Officer (MD & CEO), sources informed CNBC-TV18.

Sources close to the matter indicate a mix of internal and external contenders.

State-owned Bharat Petroleum Corporation Ltd. (BPCL) on Wednesday issued a clarification over a news report, titled “BPCL plans to set up new refinery for ₹50,000 crore”.

The state-run oil refiner said that there is no such formal proposal that has been initiated. However, the company is exploring various options for refinery expansion.

Dollar Industries Ltd, a leading player in the innerwear industry, aims for a 50% sales growth in the southern states in FY25.

The company aims for robust 11-12% year-on-year growth and targets a 50% sales increase in South India this year. Currently, Dollar Industries holds a 15% market share in India’s branded hosiery segment.

Here are a couple of stock recommendations by Jayesh Bhanushali, Lead-Research, IIFL Securities:

– Buy Kaynes Technology with a target of ₹4,000

– Buy KFIN Technologies with a stop loss of ₹695 and a target of ₹800

#JustIN | Brigade Ent launches ‘Brigade Icon Residences’ proj in Chennai’s Mount Road, proj to have dvpt potential of 0.60 msf & a revenue potential of over ₹ 1,800 cr

Brigade group to invest ₹8,000 cr in Chennai; to launch 15 msf by 2030 pic.twitter.com/a3Mg86LiP4

— CNBC-TV18 (@CNBCTV18Live) June 12, 2024

Here are a couple of stock recommendations by Soni Patnaik, JM Financial Services:

Buy AU Small Finance Bank for target price of ₹680-685 with a stop loss of ₹655

Buy MCX for target price of ₹3,900 with a stop loss of ₹3,680

Shares of TVS Supply Chain Solutions surged 8% on Wednesday, June 12, after the company secured a five-year strategic contract from Daimler Truck South East Asia Pte Ltd, a Daimler Truck AG company, for integrated supply chain solutions service in Singapore.

Shares of Oracle Financial Services Ltd. surged as much as 6% on Wednesday to ₹8,935 after parent Oracle Corp. reported strong earnings overnight in the US.

The stock is now close to its record high of ₹9,023, which it had it on April 1 this year.

Shares of Camlin Fine Sciences Ltd. were trading with gains of 8% on Wednesday, June 12. The company’s wholly owned subsidiary Dresen Quimica has entered into a share purchase agreement (SPA) to acquire 100% stake in Vitafor Invest NV, Belgium and its units. The cost of acquisition is €1.

Federal Bank surges in trade, at 52-week high as sources say KVS Manian likely external candidate whose name has been sent to RBI for MD & CEO post, as reported by CNBC-TV18 in Feb

#CNBCTV18Exclusive | Three names likely to have been submitted to #RBI for MD & CEO post of @FederalBankLtd

KVS Manian, Ex Dy MD, Kotak Mahindra Bank, is likely the external candidate, likely internal candidates are Shalini Warrier & Harsh Dugar, EDs of the bank pic.twitter.com/1Qfwee7d5C

— CNBC-TV18 (@CNBCTV18Live) June 12, 2024

Here are a few stock recommendations by Sudarshan Sukhani:

Buy Tata Chemicals with a stop loss of ₹1,020

Buy L&T with a stop loss of ₹3,365

Buy IRCTC with a stop loss of ₹1,018

Buy Astral with a stop loss of ₹2,040

PSU Banks are trading higher today, gaining up to 3%

Shares of Transformers and Rectifiers hit the upper circuit for the second day today.

The stock has been in the green for three out of the last five trade sessions.

It has gained 33.73% in the past month, 328.7% in the last six motnhs and 878.17% in the past year.

Shares of Heritage Foods Ltd., promoted by the family of Andhra Pradesh Chief Minister-elect Chandrababu Naidu, are locked in a lower circuit of 5% on Wednesday for the second consecutive session.

The stock had declined 5% in Tuesday’s trading session as well. The price band on Heritage Foods was revised to 5% from 10% earlier. The price band on June 6 was revised to 10% from 20%.

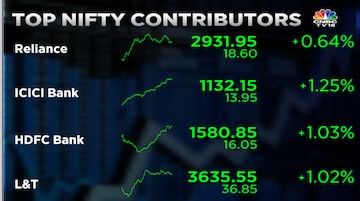

HDFC Bank, ICICI Bank, Reliance, L&T, Bharti Airtel are the top contributors towards Nifty 50’s upside.

Britannia, Titan, Asian Paints, Nestle India, HUL are the top Nifty 50 gainers.

A total of 37 out of the 50 stocks in the index ar trading with gains.