The Indian market has been doing better than its peers in the past year and market watchers expect that, though the outperformance might continue on a relative term, there will be some slowing down in the first half of 2023.

In an interview with CNBC-TV18, Sunil Koul, APAC Equity Strategist of Goldman Sachs discussed the current state of the markets and elaborated on why he has a year-end target of 20,500 for Nifty.

“We have a Nifty year-end target of 20,500 which is a low-teen return towards the second half of the year,” he said.

Koul stated that he believes the market could see an asset reallocation into fixed income due to the yield gap between equities and bonds being at a multi-year low.

Despite this, Koul is optimistic about Asia's growth prospects, with India likely to perform particularly well in the second half of the year.

Also Read | SEBI allows exchanges to launch futures contracts in corporate bond indices

“We are fairly optimistic about the Asian market overall. So we are looking at mid-teen returns for the region overall but India has been a strong outperformer for two years in a row. Our base case is, the region does fairly well, the first half will be led by China and north Asian markets notably Korea, in the second half you can see India coming back in focus and take the leadership,” he mentioned.

“India still looks like an attractive market from a secular growth perspective,” he added.

It is noteworthy that India is currently the most expensive market in the region, but that the country's relative value premium has decreased from 100 percent to 65 percent in recent months compared to its peers.

“India is still trading at 22 times forward earnings which is higher than the rest of the markets in Asia,” he explained.

Also Read | CLSA expects a 'solid' 2023 for Larsen and Toubro, anticipates 22% upside in stock price

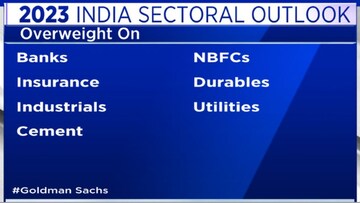

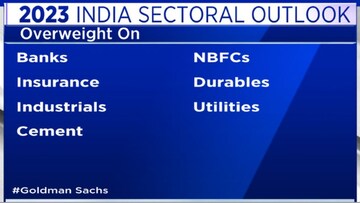

Koul also expressed support for the Make in India theme and the Production-Linked Incentive (PLI) schemes, which are divided into import substitution, energy transition, and export. However, he also acknowledged that there are downside risks to the current projections of 15 percent earnings growth.

He further stated that Goldman Sachs' estimates for the IT and consumption sectors are currently below consensus, but he believes one could see an expanding overall corporate margin drive mid-teens earnings per share (EPS) growth.

Anup Maheshwari, Co-Founder and CIO of IIFL Asset Management, also spoke with CNBC-TV18 about the current state of India's valuations. He stated that there will be some normalization in the near future.

“There is no doubt that over the course of last year, India’s relative performance and relative valuation, compared to the rest of the world, has moved to a much higher gap than the past. We would expect some normalization,” he said.

For the entire interview, watch the accompanying video

Catch the latest stock market updates with CNBCTV18.com's blog

In an interview with CNBC-TV18, Sunil Koul, APAC Equity Strategist of Goldman Sachs discussed the current state of the markets and elaborated on why he has a year-end target of 20,500 for Nifty.

“We have a Nifty year-end target of 20,500 which is a low-teen return towards the second half of the year,” he said.

Koul stated that he believes the market could see an asset reallocation into fixed income due to the yield gap between equities and bonds being at a multi-year low.

Despite this, Koul is optimistic about Asia's growth prospects, with India likely to perform particularly well in the second half of the year.

Also Read | SEBI allows exchanges to launch futures contracts in corporate bond indices

“We are fairly optimistic about the Asian market overall. So we are looking at mid-teen returns for the region overall but India has been a strong outperformer for two years in a row. Our base case is, the region does fairly well, the first half will be led by China and north Asian markets notably Korea, in the second half you can see India coming back in focus and take the leadership,” he mentioned.

“India still looks like an attractive market from a secular growth perspective,” he added.

It is noteworthy that India is currently the most expensive market in the region, but that the country's relative value premium has decreased from 100 percent to 65 percent in recent months compared to its peers.

“India is still trading at 22 times forward earnings which is higher than the rest of the markets in Asia,” he explained.

Also Read | CLSA expects a 'solid' 2023 for Larsen and Toubro, anticipates 22% upside in stock price

Koul also expressed support for the Make in India theme and the Production-Linked Incentive (PLI) schemes, which are divided into import substitution, energy transition, and export. However, he also acknowledged that there are downside risks to the current projections of 15 percent earnings growth.

He further stated that Goldman Sachs' estimates for the IT and consumption sectors are currently below consensus, but he believes one could see an expanding overall corporate margin drive mid-teens earnings per share (EPS) growth.

Anup Maheshwari, Co-Founder and CIO of IIFL Asset Management, also spoke with CNBC-TV18 about the current state of India's valuations. He stated that there will be some normalization in the near future.

“There is no doubt that over the course of last year, India’s relative performance and relative valuation, compared to the rest of the world, has moved to a much higher gap than the past. We would expect some normalization,” he said.

For the entire interview, watch the accompanying video

Catch the latest stock market updates with CNBCTV18.com's blog

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!